Last Updated on December 2, 2025 by Bilal Hasdemir

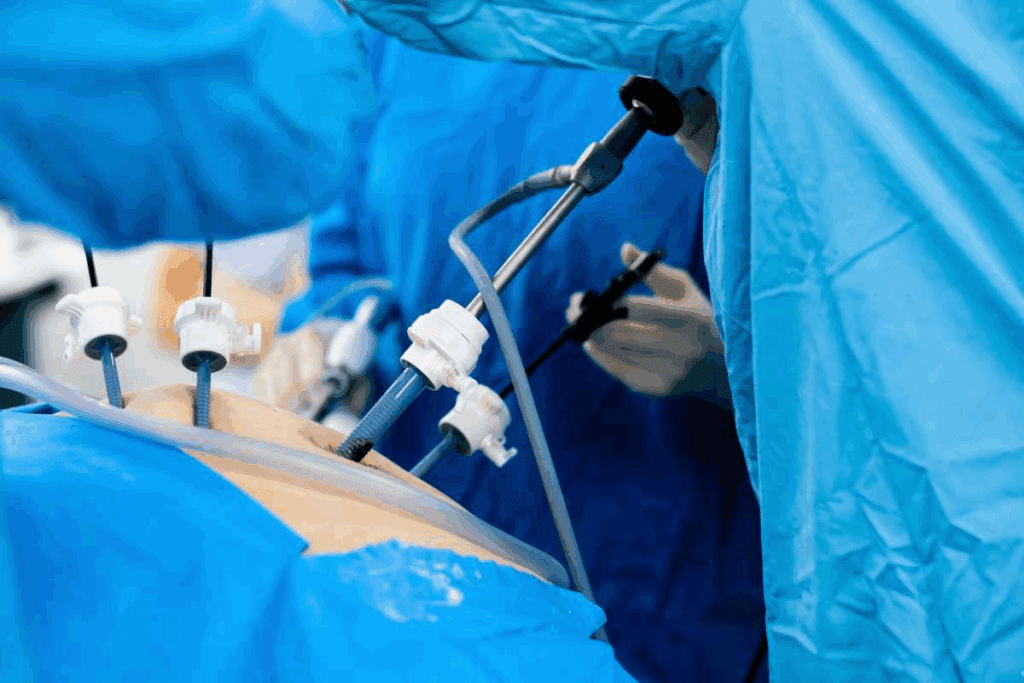

Nearly 252,000 bariatric surgeries were done in 2020, with many being gastric sleeve procedures. This surgery can change lives for those with obesity. But, the cost can be a big problem. Luckily, there are financing options to make it easier to get. Exploring financing options for gastric sleeve monthly payments for patients without full insurance coverage. Find gastric sleeve monthly payments.

Gastric sleeve surgery can be expensive. But, financing plans can break it down into smaller monthly payments. This way, patients can focus on their health without worrying about the cost upfront.

Key Takeaways

- Financing options are available for gastric sleeve surgery.

- Monthly payment plans can make the procedure more affordable.

- Bariatric financing programs offer flexible payment terms.

- Patients can choose from various affordable sleeve payment programs.

- Financing can help patients invest in their health without upfront costs.

Understanding Gastric Sleeve Surgery Costs

Gastric sleeve surgery costs a lot, and it’s important to know the financial side. This surgery is a big step towards better health.

Average Cost of Gastric Sleeve Procedures in the US

In the United States, gastric sleeve surgery can cost between $15,000 and $38,000. This wide range comes from different factors that add up to the total cost.

Factors Affecting the Total Price

Several important factors affect the total cost of gastric sleeve surgery:

- Location of the surgical facility

- Surgeon fees

- Hospital costs

- Pre-operative tests and post-operative care

Why Upfront Payment Is Challenging for Most Patients

Many patients find it hard to pay the full cost of gastric sleeve surgery upfront. The high costs make it tough for people to pay out of pocket. This is why many look into monthly installments or medical loans for sleeve procedures. Some even use credit cards for bariatric payment plans.

Knowing these costs and financing options helps patients make better choices about their health.

Insurance Coverage for Bariatric Surgery

Understanding your insurance coverage is key when planning for bariatric surgery. Many insurance plans cover bariatric surgery, including gastric sleeve procedures. But, the amount of coverage varies a lot.

Which Insurance Plans Cover Gastric Sleeve

Many insurance plans, like private insurance and government programs like Medicare and Medicaid, cover bariatric surgery. But, the details of coverage can change a lot between providers. Some plans might cover the whole procedure, while others might only cover part of it.

It’s very important to review your insurance plan carefully to know what’s covered and what’s not. Patients should also know about any pre-approval requirements or documentation needed to get coverage.

Understanding Coverage Limitations and Requirements

Coverage limits and requirements can be tricky. Insurance companies often have specific rules for coverage, like a certain BMI or proof of weight loss attempts.

“Insurance coverage for bariatric surgery is not a one-size-fits-all solution. Patients must navigate the specifics of their plan to understand their coverage.” –

A healthcare professional

Dealing with Insurance Gaps and Partial Coverage

Patients might find gaps or partial coverage in their insurance plans. In these cases, knowing about insurance gap payment sleeve options is key. Patients can look into bariatric surgery financing companies or healthcare credit monthly options to pay for what’s not covered.

By carefully looking at insurance options and understanding coverage details, patients can handle the financial side of bariatric surgery better.

Gastric Sleeve Monthly Payments: How They Work

Gastric sleeve surgery can be made more affordable with monthly payments. This helps more people get the surgery they need.

The Concept of Financing Bariatric Surgery

Financing bariatric surgery means paying for it over time. This is done through special financial plans for medical bills. Private financing for weight surgery is now more common. It lets patients start treatment without a big upfront cost.

Typical Monthly Payment Amounts

How much you pay each month for gastric sleeve surgery depends on several things. These include the surgery’s total cost, the interest rate, and how long you’ll pay. Payments can be between $200 and $500 a month. The exact amount depends on your financial situation and the financing provider.

Duration of Payment Plans

Payment plans for gastric sleeve surgery can last from a few months to a few years. Here’s a table showing some common plans and their monthly payments.

| Payment Plan Duration | Total Cost | Monthly Payment |

| 12 months | $15,000 | $1,250 |

| 24 months | $15,000 | $625 |

| 36 months | $15,000 | $417 |

Understanding your financing options can help you choose the best plan. This way, you can pick a payment plan that fits your budget. It makes the surgery more affordable and manageable.

Medical Financing Companies for Bariatric Procedures

Many financing companies offer loans for bariatric surgery. They have competitive interest rates and flexible payment plans. These companies know the special needs of bariatric patients. They help make the surgery more affordable.

Top Specialized Bariatric Surgery Financing Companies

Some top financing companies for bariatric surgery have low-interest loans and flexible plans. They have experience with bariatric patients. They understand the financial challenges of the procedure.

| Financing Company | Interest Rate | Repayment Term |

| CareCredit | 6.99% – 26.99% | 6 to 60 months |

| United Medical Credit | 0% – 29.99% | 6 to 60 months |

| AccessOne MedCard | 6.95% – 29.95% | 12 to 60 months |

Application Process and Requirements

The application for bariatric surgery financing includes a credit check and income verification. Patients must provide financial details. This includes income and credit history to check eligibility.

Approval Rates and Considerations

Approval rates for bariatric surgery financing vary. They depend on the lender and the patient’s credit. Patients with good credit scores are more likely to get financing with better rates.

It’s important for patients to review the terms and conditions before choosing a financing plan. Understanding the options and requirements helps patients make informed decisions for bariatric surgery financing.

Hospital and Clinic Payment Plans

Many patients looking into gastric sleeve surgery check out financing options with their healthcare providers. This way, they can get payment plans that fit their needs better.

In-House Financing Options

Hospitals and clinics offer in-house financing options or payment plans. These plans let patients pay for gastric sleeve surgery in smaller, easier-to-handle installments. They can be adjusted to match each patient’s financial situation.

Negotiating Directly with Healthcare Providers

Talking directly to healthcare providers can lead to better deals. You might get zero or low-interest rates. It’s a good idea to ask about these options when you’re discussing your surgery.

Benefits of Provider-Based Payment Plans

The perks of provider-based payment plans include:

- Flexible payment schedules

- Potential for zero or low-interest rates

- Personalized financial arrangements

By working with healthcare providers, patients can set up a patient payment monthly plan that works for them. This makes medical finance gastric sleeve procedures more reachable.

Medical Credit Cards and Bariatric Surgery

Medical credit cards are a handy way to finance bariatric procedures. They are made for those who need to cover costs, like for gastric sleeve surgery.

CareCredit and Other Medical Credit Options

CareCredit is well-known for helping patients with bariatric surgery costs. Other options are out there too, each with its own benefits and rules. It’s smart to look into them to find the best fit for your budget.

Interest Rates and Promotional Periods

Many cards offer low or no interest for a while. But, it’s key to know when this ends. Rates can jump up after the deal is over. So, it’s important to plan your payments carefully.

Pros and Cons of Using Medical Credit Cards

Medical credit cards have good points and bad. They can give you the cash you need right away. But, there are risks like high interest later and getting into debt if not managed right.

In short, medical credit cards can help with bariatric surgery costs. They offer flexibility and ease. But, it’s important to understand the terms well before deciding.

Personal Loans for Gastric Sleeve Surgery

Personal loans are a good choice for those thinking about gastric sleeve surgery. They let patients get the surgery done without paying the whole cost at once.

Banks vs. Online Lenders

Patients looking for a personal loan for gastric sleeve surgery have two options: banks and online lenders. Banks usually have better interest rates but are stricter. Online lenders are easier to apply with and might accept lower credit scores.

Secured vs. Unsecured Loan Options

Personal loans can be secured or unsecured. Secured loans need collateral, like a car or house. Unsecured loans, more common for medical needs, don’t need collateral but might have higher rates.

How to Compare Loan Terms for Medical Procedures

When looking at loan terms, consider interest rates, repayment periods, and fees.

“It’s key to read the loan agreement well to know the total cost,”

say financial experts. By comparing these aspects from different lenders, patients can find the best loan for them.

Exploring personal loan options makes gastric sleeve surgery more affordable. It’s important to think about the pros and cons of each loan. Choose the one that suits your situation best.

Low-Interest Financing Options for Weight Loss Surgery

The cost of bariatric surgery can be a big hurdle for many. But, low-interest financing options are making it more affordable. Now, patients can look into financial help programs to make gastric sleeve surgery more accessible.

Finding the Best Interest Rates

Many financing companies offer low-interest loans for bariatric surgery. They aim to make weight loss surgery affordable. They provide competitive rates to help patients manage the costs.

Zero-Interest Promotional Offers

Some lenders offer zero-interest promotional deals. This makes it easier for patients to get surgery without a big upfront cost. These deals are great for those who can pay off the loan quickly.

Qualification Requirements

To get low or zero-interest financing, patients need a good credit score. Lenders also look at income and other financial factors to decide if you qualify.

Hidden Fees to Watch For

Low-interest financing sounds good, but it’s important to read the fine print. Some agreements might have hidden fees or charges. These can increase the total cost.

| Financing Option | Interest Rate | Qualification Requirements |

| CareCredit | 0% – 26.99% | Good credit score, income verification |

| United Medical Credit | 0% – 18% | Credit score, financial history |

| AccessOne MedCard | 0% – 29.99% | Creditworthiness, income |

Monthly Cost Breakdown for Gastric Sleeve Procedures

Gastric sleeve surgery has many costs. It’s important to know these to plan your budget well.

Pre-Surgery Expenses

Before surgery, you’ll spend money on several things. These include:

- Consultation fees with healthcare providers

- Diagnostic tests such as blood work and imaging studies

- Nutritional counseling and psychological evaluations

Surgery and Hospital Costs

The biggest cost is the surgery and hospital stay. This includes:

- Surgeon’s fees

- Anesthesiologist’s fees

- Hospital charges for the operating room and recovery

| Expense Category | Average Cost |

| Pre-Surgery Expenses | $500 – $1,000 |

| Surgery and Hospital Costs | $15,000 – $25,000 |

| Post-Surgery Follow-Up | $500 – $1,500 |

Post-Surgery Follow-Up and Medication Expenses

After surgery, you’ll need to pay for follow-up care and medication. This includes:

- Follow-up appointments with healthcare providers

- Vitamin and mineral supplements

- Potential additional costs for managing complications

Creating a Comprehensive Budget Plan

To handle the costs of gastric sleeve surgery, make a detailed budget plan. This means:

- Adding up all costs before, during, and after surgery

- Looking into financing options like loans or credit cards

- Checking if insurance covers any costs

By understanding the costs and financing options, you can make smart choices about your care.

Qualifying for Bariatric Surgery Financing

To qualify for bariatric surgery financing, your financial health and creditworthiness are checked. Each financing company has its own set of rules. But, there are key factors most lenders look at.

Credit Score Requirements

A high credit score is key for good financing terms. Most lenders want a score of at least 650. But, some might consider lower scores too.

Income Verification Process

Lenders need proof of steady income. This is to make sure you can pay back the loan each month. They might ask for pay stubs, tax returns, or other financial papers.

Options for Patients with Poor Credit

Even with poor credit, you might find financing options. For example, secured loans or lenders that work with bad credit.

| Financing Option | Credit Score Requirement | Income Verification |

| Unsecured Loan | 650+ | Required |

| Secured Loan | 600+ | Required |

| Alternative Lender | Variable | Required |

Financial Assistance Programs for Weight Loss Surgery

Financial help is available for those thinking about gastric sleeve surgery. These programs make it easier for people to get the surgery they need.

Non-Profit Organizations and Grants

Many non-profit groups give grants and financial aid for weight loss surgery. They have rules like income limits or health needs. For example, some help those who haven’t lost weight with other methods.

State-Specific Assistance Programs

Some states have programs to help with medical costs, including weight loss surgery. These programs change by state and have their own rules. It’s good to look into what’s available in your state.

Tax Deductions for Medical Procedures

There are tax breaks for medical costs, including surgery. The IRS lets you deduct medical expenses that are a certain percentage of your income. Talking to a tax expert can help you understand what you can deduct.

Conclusion: Making Gastric Sleeve Surgery Financially Accessible

Gastric sleeve surgery can change lives for those fighting obesity. Now, thanks to various financing options, it’s easier to afford. By looking into affordable sleeve payment programs and bariatric financing payment plans, people can start their journey to better health.

Creating a detailed budget is key. It helps understand the costs, from pre-surgery to post-surgery care. This way, patients can plan wisely and reach their weight loss goals without financial stress.

To make gastric sleeve surgery affordable, careful planning is essential. Patients should look into different financing options. This includes medical financing companies, hospital plans, and personal loans. Finding the right one can make a big difference.

FAQ

What financing options are available for gastric sleeve surgery?

You can explore medical credit cards, personal loans, and bariatric surgery financing companies. Hospitals and clinics also offer in-house financing or payment plans.

How much does gastric sleeve surgery typically cost?

The cost varies from $15,000 to $38,000 in the US. It depends on location, surgeon fees, and hospital costs.

Will insurance cover the cost of gastric sleeve surgery?

Yes, insurance covers bariatric surgery, including gastric sleeve. Private insurance and government programs like Medicare and Medicaid offer coverage. But, there are complex requirements and limitations.

What are the typical monthly payment amounts for gastric sleeve surgery financing?

Monthly payments vary. They depend on the financing provider, surgery cost, and payment plan duration.

How do I qualify for bariatric surgery financing?

You need a good credit score and income verification to qualify. Even with poor credit, secured loans or alternative lenders might be available.

Are there any financial assistance programs available for weight loss surgery?

Yes, non-profit organizations, grants, and state programs offer financial help. Tax deductions for medical procedures might also apply.

Can I negotiate directly with healthcare providers for a payment plan?

Yes, talking directly with providers can lead to better terms. You might get zero or low-interest rates.

What are the pros and cons of using medical credit cards for bariatric surgery financing?

Medical credit cards, like CareCredit, offer low rates and flexible terms. But, be aware of high rates after promotional periods end.

How can I create a budget plan for gastric sleeve surgery?

List all costs, including pre-surgery, surgery, and post-surgery expenses. This helps create a detailed budget plan.

What are the benefits of using a personal loan for gastric sleeve surgery financing?

Personal loans have competitive rates and terms. You can choose between secured and unsecured loans based on your financial situation.

Are there any low-interest financing options available for weight loss surgery?

Yes, low or zero-interest rates are available from specialized lenders. Good credit scores often qualify you.

What are the additional costs associated with gastric sleeve surgery?

Costs include pre-surgery, post-surgery, and medication expenses. These should be included in your budget plan.

References

National Center for Biotechnology Information. Evidence-Based Medical Insight. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6957980/