Last Updated on November 27, 2025 by Bilal Hasdemir

The cost of medical procedures can be a big worry for patients. Robotic heart surgery is both complex and expensive. We know it’s hard to figure out insurance for such advanced treatments.

In this guide, we aim to clear up the costs of robotic cardiovascular surgery. We also explain how insurance helps cover these costs. Our goal is to help patients make smart choices about their health.

Understanding the cost of robotic heart surgery is key for patients. We’ll look at what makes the price go up. This includes the procedure’s complexity, the hospital’s location, and the surgeon’s fees.

In the United States, robotic heart surgery costs between $30,000 and $60,000. This range varies based on several factors. These include the surgery’s complexity, the hospital’s location, and the surgeon’s fees.

Studies show the average cost for robotic coronary bypass is about $45,000. This includes hospital stay, surgical fees, and equipment costs.

Let’s break down the costs of robotic heart surgery:

| Cost Component | Average Cost | Range |

| Hospital Fees | $20,000 | $15,000 – $30,000 |

| Surgeon Fees | $10,000 | $5,000 – $15,000 |

| Equipment Costs | $5,000 | $3,000 – $8,000 |

| Total | $35,000 | $23,000 – $53,000 |

Robotic heart surgery is more expensive than traditional surgery. This is due to the cost of equipment and specialized training. Yet, it often leads to shorter hospital stays and quicker recovery times.

A study found robotic coronary bypass costs more upfront. But, it leads to fewer complications and shorter hospital stays. This can make the overall cost difference smaller over time.

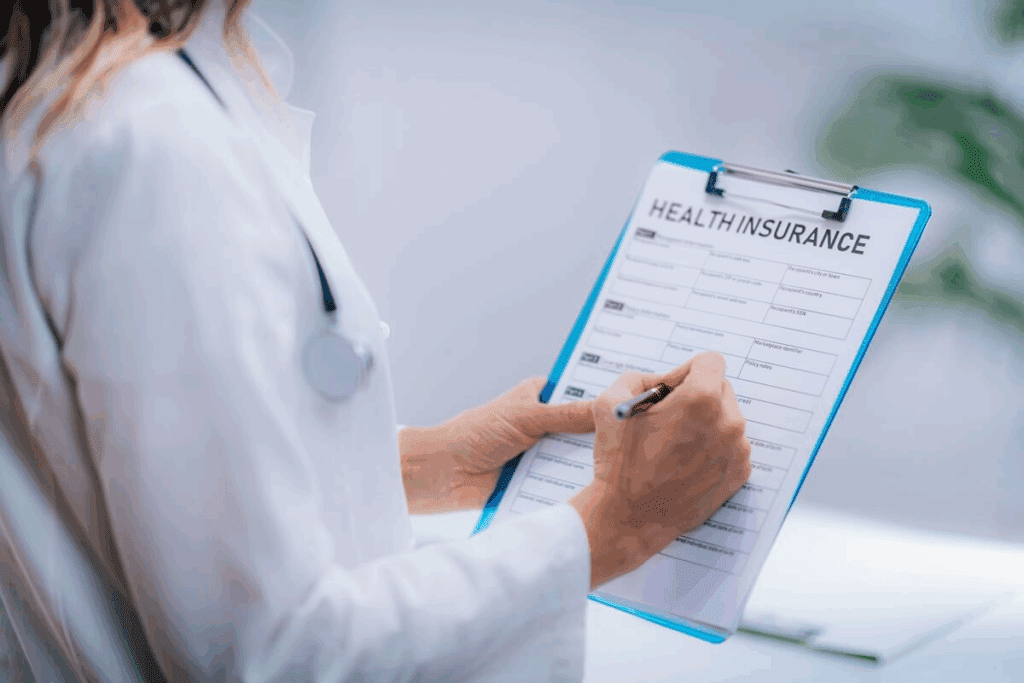

As medical technology gets better, knowing about health insurance is key for patients. This is true for treatments like robotic cardiothoracic surgery. The U.S. health insurance scene is complex, with many options and things to think about when picking a plan.

In the United States, there are many health insurance plans. Each has its own good points and limits. These include:

It’s important to know the differences between these plans. This helps you choose the best one for your needs, like when you need robot heart surgery.

Health insurance plans have terms that affect how much you pay out-of-pocket. Key terms to grasp include:

Knowing these terms helps you understand your health insurance better. It lets you make better choices about your care.

Another important thing about health insurance is the difference between in-network and out-of-network providers. In-network providers have a deal with your insurance company. This usually means lower costs for you. Out-of-network providers don’t have this deal, which can lead to higher costs or even you having to pay everything.

When you’re thinking about a procedure like robotic heart surgery, check if your providers are in-network. This helps keep your costs down.

With new medical tech, knowing if robotic heart surgery is covered by insurance is key. Coverage varies a lot, depending on your insurance plan and policy.

Many worry about Medicare covering robotic heart surgery. Medicare usually covers necessary procedures, including some robotic heart surgeries. But, how much it covers can change based on your Medicare plan and situation.

Medicaid’s coverage for robotic heart surgery changes by state. Some states might cover it under certain conditions, while others might not. It’s best to check your state’s Medicaid policy for details.

Private insurance companies have different rules for robotic heart surgery. Some might cover it fully, while others might need you to get approval first. Always check your policy or talk to your insurance to know what’s covered.

Health plans from employers can also differ a lot. These plans often have different levels of coverage and might only cover in-network providers. It’s important to look at your plan documents or talk to HR for more info.

The table below shows how different insurance plans cover robotic heart surgery:

| Insurance Type | Coverage for Robotic Heart Surgery | Notes |

| Medicare | Generally covered if medically necessary | Varies by specific Medicare plan |

| Medicaid | Varies by state | Check state-specific Medicaid policies |

| Private Insurance | Varies by insurer and policy | May require pre-authorization |

| Employer-Sponsored | Varies by plan | Check plan documents or HR department |

It’s vital to know the details of your insurance when thinking about robotic heart surgery. Don’t be shy to contact your insurance to clear up any questions or requirements.

It’s important for patients to know what affects insurance for robotic heart bypass surgery. Several key elements can change how much you pay out of pocket. These factors include the type of surgery, your insurance plan, and where you live.

Insurance coverage often depends on if the surgery is medically necessary. Insurers check if the surgery is needed based on your health and tests. A doctor’s advice also plays a big role.

Criteria for Medical Necessity:

Many plans need pre-authorization for robotic heart surgery. This means your doctor must ask your insurance before the surgery. They give details about your health and the surgery plan.

“Pre-authorization is a critical step in ensuring that the procedure is covered by insurance. It allows the insurance company to review the case and determine whether the procedure meets their criteria for coverage.”

A Cardiothoracic Surgeon

Being treated by an in-network surgeon and hospital can save you money. In-network care usually means lower costs for you.

| Provider Status | Typical Coverage | Patient Costs |

| In-Network | Higher coverage percentage | Lower copays and deductibles |

| Out-of-Network | Lower coverage percentage | Higher copays and deductibles |

Coverage for robotic heart surgery can change depending on where you live. Some places have more in-network providers than others.

Knowing these factors helps patients deal with insurance for robotic heart surgery. It’s key to work with your doctor and insurance to get the coverage you need.

Getting insurance approval for robotic heart surgery starts with good documentation. Patients and doctors must work together to collect and send the right papers.

Medical records are key for insurance approval. They should have patient history, past treatments, and test results like echocardiograms. Accurate and thorough documentation helps insurers see why the robotic surgery is needed.

Doctor statements are very important for insurance claims. The surgeon and other doctors should explain why robotic heart surgery is best. Clear and compelling physician statements can make the claim stronger.

Prior authorization forms are a big part of getting insurance approval. They need details about the surgery, the surgeon, and the hospital. It’s important to fill these out right and send them on time.

Insurance companies want to see proof that robotic heart surgery works. This can include studies on its safety and benefits. Providing robust clinical evidence can show why the robotic method is needed and help get approval.

By collecting and sending these important documents, patients and doctors can help get insurance approval for robotic heart surgery. This ensures patients get the care they need.

Checking if your insurance covers robotic heart surgery is key when planning your heart care. We’ll guide you through this process. This way, you’re ready to deal with insurance coverage complexities.

To know if your insurance covers robotic heart surgery, ask the right questions. First, call your insurance provider. Ask about their policies on robotic cardiothoracic surgery.

These questions will help you understand what’s covered and what to do next.

Hospital financial services are key in understanding robotic heart surgery costs. They can give you details on hospital fees, surgeon fees, and equipment costs.

| Cost Component | Description | Estimated Cost |

| Hospital Fees | Includes room, nursing, and hospital services | $20,000 – $50,000 |

| Surgeon Fees | Fees for the surgeon’s services | $5,000 – $15,000 |

| Equipment Costs | Costs associated with robotic surgery equipment | $3,000 – $8,000 |

Working with hospital financial services can clarify these costs and insurance coverage.

After asking about insurance coverage and working with hospital financial services, understand your coverage documents. Carefully review your insurance policy documents. Look at the fine print.

Key aspects to look for include:

Knowing your coverage documents well can prevent unexpected medical bills. It makes your robotic heart surgery financial process smoother.

Getting a denial from your insurance for robotic heart surgery can be tough. But, there are steps you can take to fight the decision. Knowing your options is key to getting the treatment you need.

The first thing to do is appeal the insurance company’s decision. You’ll need to provide more info or documents that show why robotic heart surgery is needed. It’s important to work with your healthcare provider to get these documents. They might include medical records, test results, and a doctor’s letter explaining why robotic surgery is best for you.

“The appeals process can be complex and time-consuming,” but don’t give up. “Patients who are well-prepared and supported by their healthcare team often see successful outcomes,” say patient advocacy groups.

If appealing doesn’t work, getting a second opinion is a good next step. A specialist can give a fresh look at your condition and if robotic heart surgery is right for you. A second opinion can also add more evidence to your appeal, making your case stronger.

If insurance keeps saying no, look into other ways to pay for surgery. Some hospitals and surgical centers have financing plans or patient help programs. Ask about these options when talking about your treatment with your doctor.

“Financial assistance programs can greatly lessen the cost of complex surgeries like robotic heart procedures,” said a financial advisor at a leading cardiac care center.

By understanding appeals, getting more medical opinions, and looking into financing, you can keep going after robotic heart surgery even with an initial denial. Being persistent and having the right support can really help you get the care you need.

Patients looking into robotic heart surgery can find help through various programs. These include hospital-based aid, nonprofit support, and government help. These resources aim to make the surgery more affordable for those in need.

Robotic heart bypass surgery, like robotic coronary bypass, can be expensive. But, there are financial aid programs available. We’ll look at the different types of assistance that can help with the costs of robotic heart surgery.

Many hospitals have financial aid programs for robotic heart surgery costs. These programs offer discounts, payment plans, or other forms of support. For instance, some hospitals adjust fees based on a patient’s income.

Types of Hospital-Based Assistance:

Nonprofit groups and foundations also offer financial aid for heart surgery, including robotic procedures. They provide grants, scholarships, or other forms of support.

Examples of Nonprofit Assistance:

| Organization | Type of Assistance | Eligibility Criteria |

| Heart Foundation | Grants for heart surgery | Financial need, medical necessity |

| Cardiac Care Foundation | Scholarships for cardiac patients | Income level, insurance status |

| National Heart Association | Financial aid for heart procedures | Medical diagnosis, financial need |

Government programs also offer financial help for those without insurance. These programs vary by state and include Medicaid, state-specific health insurance, and other initiatives.

Examples of Government Assistance:

Exploring these financial aid options can make robotic heart surgery more affordable. It’s wise to talk to hospital financial counselors to find the best help.

Understanding insurance for robotic heart surgery can be tough. But, real stories from patients help a lot. We share their journeys with insurance to give you insights.

A 55-year-old from California needed heart surgery. They chose robotic surgery and their insurance covered it. The patient had a smooth recovery.

Another patient was denied for open-heart surgery but got robotic surgery approved. This was because robotic surgery is less invasive.

Many face hurdles getting insurance for robotic heart surgery. A big problem is unclear policy guidelines. Patients work with doctors to get the right documents.

When denied, patients appeal with more evidence. For example, a New York patient appealed and won coverage after more evidence.

Key lessons include working with doctors and knowing your policy well. It’s also helpful to get support from advocacy groups and hospital services.

These resources offer guidance and help find financial aid. They make navigating insurance easier.

It’s important for patients to know about insurance for robotic heart surgery. We’ve looked at the costs of this surgery in the U.S. This includes hospital fees, surgeon costs, and equipment expenses.

Insurance for robotic heart surgery changes based on your plan and if it’s medically needed. You need to talk to your doctor and insurance to see if you’re covered. If not, you can appeal the decision.

Robotic heart bypass surgery has many benefits. It means less time recovering and less invasive procedures. We want to help make this treatment available to more people by sharing this information.

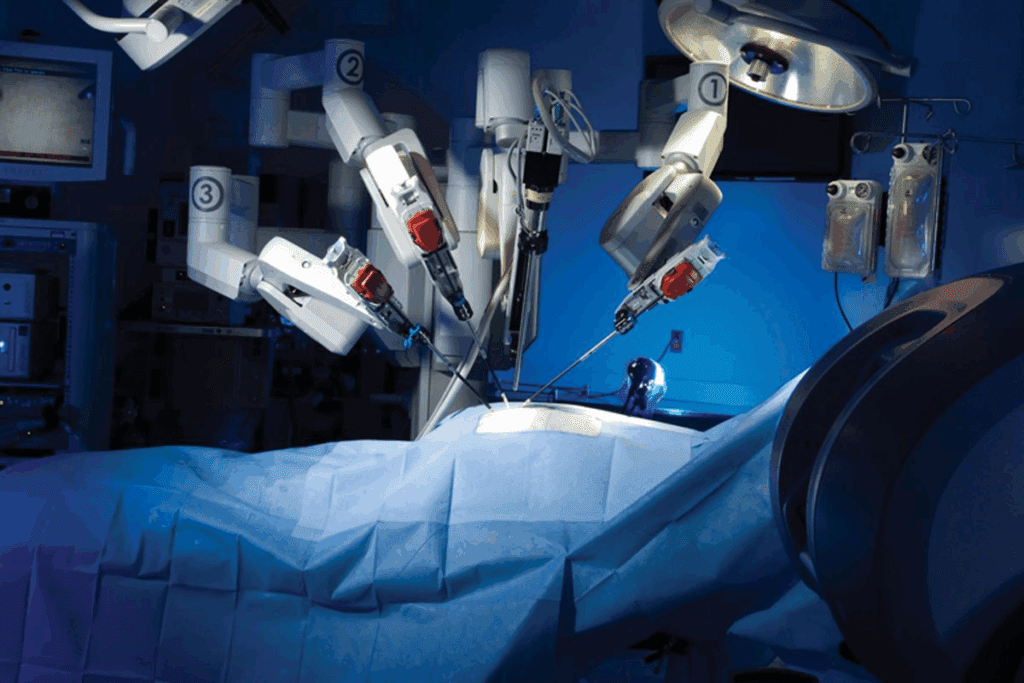

Robotic heart surgery is a new way to do heart surgery. It uses a robotic system for the operation. This method has smaller cuts, which might mean less pain and a faster recovery.

The cost of robotic heart surgery varies a lot. It depends on where you are, hospital fees, surgeon costs, and the equipment needed. Costs can range from a few thousand to tens of thousands of dollars.

Medicare might cover robotic heart surgery, but it depends on the procedure and if it’s needed. Generally, Medicare pays for necessary procedures, but details can change.

To check if your insurance covers robotic heart surgery, look at your policy. You should also call your insurance company. Ask about coverage for robotic cardiac procedures and any needed approvals.

Several things can affect insurance coverage. These include if the surgery is needed, if you need approval first, your surgeon and hospital’s insurance status, and where you live.

You’ll need medical records, test results, doctor statements, and approval forms. You’ll also need proof that the robotic method is best.

If insurance denies coverage, you can appeal. You might also get a second opinion or look into other ways to pay for the surgery.

Yes, there are programs to help. These include financial help from hospitals, nonprofit groups, and government programs for those who can’t afford it.

Read your documents carefully. If you’re unsure, call your insurance or the hospital’s financial office for help.

Robotic heart surgery has many advantages. It has smaller cuts, less pain, fewer complications, and quicker healing times than traditional surgery.

Robotic heart surgery is good for some heart issues but not all. It depends on the condition, your health, and the surgeon’s opinion.

To find a skilled surgeon, ask your doctor for recommendations. Look for certifications and check the surgeon’s robotic surgery success rates.

Subscribe to our e-newsletter to stay informed about the latest innovations in the world of health and exclusive offers!