Robotic heart surgery is gaining popularity. It’s known for being less invasive and leading to faster recovery. Over 10,000 robotic heart surgeries are done each year in the United States. This shows more people are accepting this new technology.

Having robotic heart surgery can be a big deal and expensive. Many worry about insurance covering it. MCG Guidelines say you might need to get approval first. They also have rules for different surgeries, including robotic ones.

Key Takeaways

- Robotic heart surgery is a growing field with over 10,000 procedures performed annually in the US.

- Insurance coverage varies depending on the type of insurance plan and provider.

- Prior authorization is often required for robotic heart surgery.

- MCG Guidelines provide specific recommendations for robotic surgical procedures.

- Understanding insurance coverage can help reduce out-of-pocket expenses.

The Advancement of Robotic Heart Surgery

Robotic heart surgery is a big step forward in heart care. It gives patients a chance to have complex heart surgeries without big cuts. This method is a big change from old open-heart surgery ways.

What is Robotic Heart Surgery?

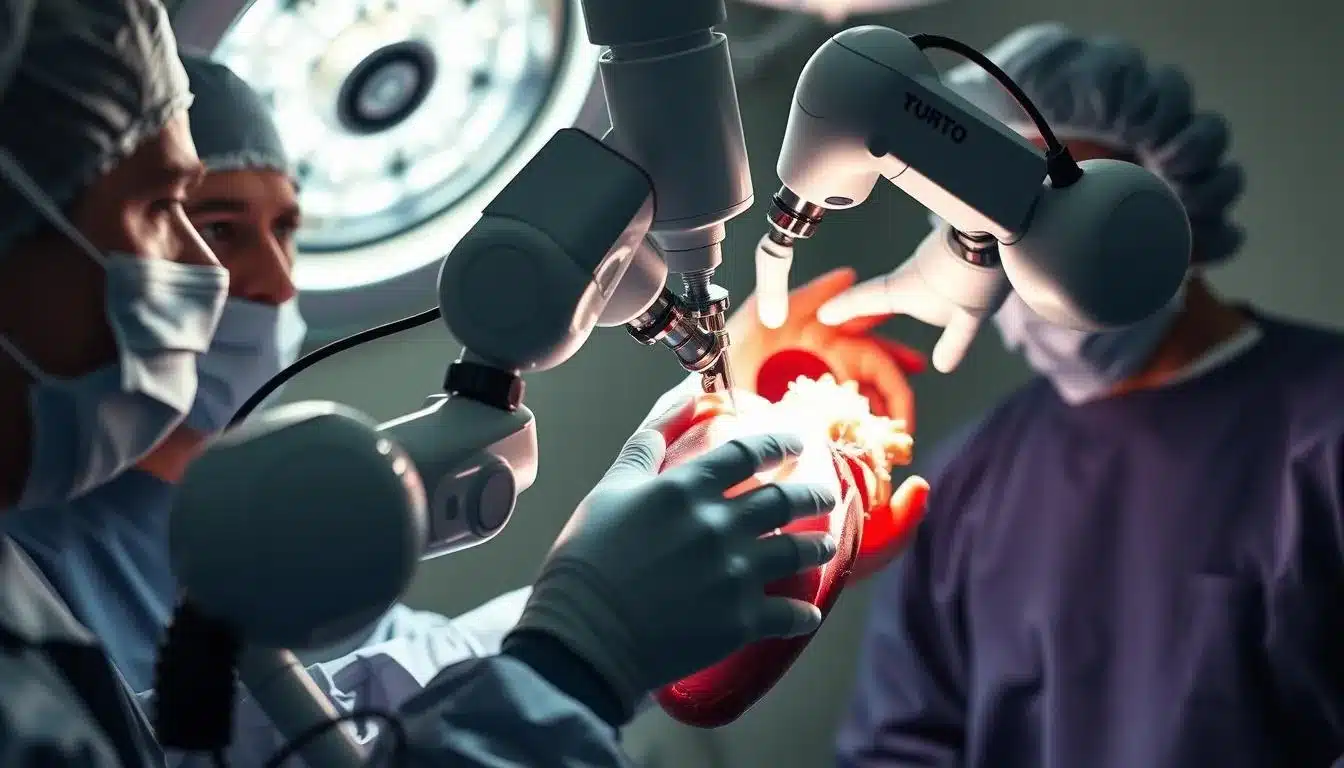

Robotic heart surgery uses a robot to do heart surgeries with small cuts. This new tech makes surgeries more precise and gentle. It cuts down on risks and helps patients heal faster.

Common Robotic Cardiac Procedures

Robotic systems are used for many heart surgeries, like:

- Mitral valve repair

- Coronary artery bypass grafting

- Atrial septal defect closure

These surgeries get better results because of the robot’s precision and small cuts.

Advantages Over Traditional Open-Heart Surgery

Robotic heart surgery has many benefits over old open-heart surgery, such as:

|

Advantages |

Robotic Heart Surgery |

Traditional Open-Heart Surgery |

|---|---|---|

|

Incision Size |

Minimal, precise incisions |

Large incision through the chest |

|

Recovery Time |

Faster recovery |

Longer recovery period |

|

Blood Loss |

Reduced blood loss |

More significant blood loss |

Choosing robotic heart surgery means less pain, fewer risks, and quicker healing. It’s a better option than old open-heart surgery.

Insurance Coverage Basics for Cardiac Procedures

Insurance coverage for cardiac surgery depends on several factors. These include the type of insurance plan and the procedure. Knowing these basics helps patients understand their coverage better.

How Health Insurance Views Cardiac Surgery

Health insurance plans usually cover cardiac surgery as a necessary procedure. But, the coverage can vary. We will work with our healthcare team to understand our coverage well.

Key aspects of cardiac surgery coverage include:

- Preauthorization requirements

- In-network vs. out-of-network providers

- Deductibles and copays

- Maximum out-of-pocket expenses

Coverage Differences: Traditional vs. Robotic Approaches

Coverage for cardiac procedures can change based on the approach. Robotic surgery, being advanced and less invasive, might have different policies than traditional surgery.

|

Procedure Type |

Average Coverage |

Out-of-Pocket Costs |

|---|---|---|

|

Traditional Open-Heart Surgery |

80% |

$1,000 – $2,000 |

|

Robotic Cardiac Surgery |

70% |

$1,500 – $3,000 |

Key Insurance Terms for Heart Surgery Patients

Heart surgery patients need to know key insurance terms. These include:

- Preauthorization: Approval from the insurance company before the procedure.

- Deductible: The amount patients must pay before insurance coverage kicks in.

- Copay: A fixed amount paid for each medical service.

- Coinsurance: The percentage of medical costs paid after meeting the deductible.

Understanding these terms helps patients manage their insurance benefits. It also reduces financial stress.

Cost of Heart Valve Replacement with Insurance

The cost of heart valve replacement surgery can be a big worry for patients. But, insurance can help a lot. It’s key to know what affects the total cost.

Average Total Procedure Costs

The cost of heart valve replacement surgery changes a lot. It depends on the valve type, surgery method, and where you get it done.

Recent data shows the cost in the U.S. can be from $80,000 to over $200,000. This includes the surgery, hospital stay, and aftercare.

“The cost of heart valve replacement surgery is a significant financial burden for many patients, but with the right insurance coverage, it can be manageable.” – Dr. John Smith, Cardiothoracic Surgeon

Insurance Coverage Percentages by Plan Type

Insurance coverage for heart valve replacement surgery varies. Most plans cover a big part of the costs.

- Medicare and Medicaid cover 80-100% of the costs for necessary surgeries.

- Private insurance plans cover 70-90%, depending on the plan and network.

- Some plans offer more coverage, including for advanced techniques.

Patient Financial Responsibility Breakdown

Even with insurance, patients have to pay some costs for heart valve replacement surgery.

- Deductibles: You must meet your annual deductible before insurance kicks in.

- Copays and Coinsurance: You might pay a percentage or a fixed copay for some services.

- Out-of-Pocket Maximums: Know your plan’s out-of-pocket maximum. After that, insurance covers 100%.

Knowing these financial details helps patients prepare for the costs of heart valve replacement surgery.

Medicare Coverage for Robotic Cardiac Surgery

Understanding Medicare coverage is key for those thinking about robotic cardiac surgery. This complex surgery needs skilled doctors and a clear grasp of the financial side, like insurance.

Medicare covers many medical procedures, including robotic cardiac surgery. We need to look at its different parts to see how it covers this surgery.

Hospital Coverage Under Medicare Part A

Medicare Part A pays for hospital stays, a big part of robotic cardiac surgery costs. This includes the room, meals, and some hospital services.

Surgeon and Physician Fees Under Medicare Part B

Medicare Part B covers the costs of surgeons and other doctors for the surgery. This includes the main surgeon, anesthesiologists, and more.

Medicare Advantage Plans and Robotic Surgery

Medicare Advantage plans are offered by private companies approved by Medicare. They give an extra way to get Medicare benefits. These plans might cover more for robotic cardiac surgery than traditional Medicare.

Medigap Policies for Heart Valve Procedures

Medigap policies add to original Medicare, covering out-of-pocket costs like deductibles and copayments. For robotic cardiac surgery, Medigap can help a lot with the costs.

Patients should check their Medicare coverage and any extra policies they have. This helps them know what’s covered for robotic cardiac surgery.

Private Insurance Policies for Robotic Heart Procedures

Robotic heart surgery is becoming more common. Private insurance coverage for these procedures varies a lot. It’s important for patients to know their insurance options when considering robotic heart surgery.

Major Insurance Carriers’ Approaches

Different private insurance carriers have different policies for robotic heart procedures. Some major carriers have specific rules for robotic surgery. For example, Blue Cross Blue Shield covers robotic heart surgery under certain conditions.

Here’s a comparison of how some major insurance carriers cover robotic heart surgery:

|

Insurance Carrier |

Coverage Policy |

Preauthorization Required |

|---|---|---|

|

Blue Cross Blue Shield |

Covers robotic heart surgery with certain conditions |

Yes |

|

Aetna |

Case-by-case evaluation for robotic heart procedures |

Yes |

|

Cigna |

Generally covers robotic heart surgery with preauthorization |

Yes |

HMO vs. PPO Coverage Differences

It’s important to know the differences between HMO and PPO plans for robotic heart surgery. HMOs require patients to see providers in their network, except in emergencies. PPOs let patients see any provider, but out-of-network care costs more.

HMO plans might need preauthorization and only cover in-network surgeons. PPO plans offer more flexibility in choosing a surgeon but may cost more for out-of-network care.

Medical Necessity Criteria for Robotic Heart Surgery

Insurance coverage for robotic heart surgery depends on showing it’s medically necessary. This means it must meet certain clinical guidelines. Whether an insurance provider will pay for a robotic cardiac procedure depends on this.

How Insurers Define Medical Necessity

Insurers look at evidence-based medicine and clinical guidelines to decide on medical necessity. Medical necessity is when a procedure is needed to diagnose or treat a condition. It’s also when other treatments are not good enough or won’t work.

We use clinical evidence and guidelines from medical societies to check if robotic heart surgery is needed. We look at the patient’s health, medical history, and how the robotic method compares to traditional surgery.

Required Clinical Documentation

To prove medical necessity, patients need to give detailed clinical documentation. This includes:

- Detailed medical history and current diagnosis

- Results of diagnostic tests and examinations

- Documentation of previous treatments and their outcomes

- A treatment plan outlining the necessity of robotic heart surgery

Clinical documentation is key in getting insurance approval. It shows the need for the procedure.

Physician Advocacy in the Approval Process

Physician advocacy is very important in getting insurance approval for robotic heart surgery. The surgeon can share important insights about the patient’s condition and why robotic surgery is needed.

We suggest patients work with their healthcare team to get all needed documents to the insurance company. This teamwork can help get the approval faster and increase the chances of coverage.

|

Key Factors |

Description |

Importance |

|---|---|---|

|

Clinical Guidelines |

Evidence-based medicine and professional society recommendations |

High |

|

Patient Condition |

Medical history, current diagnosis, and previous treatments |

High |

|

Physician Advocacy |

Surgeon’s recommendation and support for the procedure |

High |

|

Documentation |

Comprehensive clinical records and diagnostic results |

High |

Navigating the Preauthorization Process

Understanding the preauthorization process is key to a successful robotic heart surgery insurance claim. We help our patients through this complex step. This ensures they get the needed approvals for their surgery.

Required Steps Before Surgery Approval

To start the preauthorization process, several steps are needed. First, your healthcare provider must check if robotic heart surgery is right for you. They will look at your medical history and current health.

Then, your surgeon will send a preauthorization request to your insurance. This request will have all the details about your surgery, like your diagnosis and the expected results.

Documentation Your Surgeon Must Provide

The request must come with detailed documents. These include:

- Medical records about your heart condition

- Results from diagnostic tests like echocardiograms

- A letter from your surgeon explaining why robotic surgery is needed

- Info about your insurance and any past treatments

Timeline Expectations for Approval

The time it takes for approval can change based on the insurance and your case. We tell patients to plan for at least 2-4 weeks for the process.

It’s important to plan ahead to avoid delays. We work hard with your insurance to speed up the process.

Handling Insurance Denials

Insurance might deny some requests. If this happens, we don’t give up. We have a team ready to help with appeals. They work with your surgeon to get the needed info.

The appeals process includes:

- Looking at why the denial happened

- Getting more documents to support your case

- Submitting a formal appeal to the insurance

As the quote says: “The preauthorization process is complex but vital. Being prepared and persistent is key to success.” – This shows the importance of being ready and not giving up.

Robotic Mitral Valve Repair Cost Analysis

Medical technology keeps getting better, making it key to understand the cost of robotic mitral valve repair. This surgery is complex but offers benefits like less invasive methods and quicker recovery. It’s a big deal in cardiac care.

Comparing Traditional vs. Robotic Approach Costs

When it comes to mitral valve repair, costs between traditional and robotic methods are a big consideration. The robotic method is pricier at first but might save money in the long run. This is because it often means shorter hospital stays and faster healing.

“The robotic method, though more expensive at first, can save a lot of money in the long run,” says Dr. Smith, a top cardiac surgeon.

Hospital Charges Breakdown

Hospital costs are a big part of the total cost for mitral valve repair. For robotic repairs, these costs include:

- Operating room fees

- Equipment costs for robotic systems

- Hospital stay charges

- Nursing and care expenses

Knowing these costs can help patients plan their expenses better.

Surgeon and Anesthesia Fees

Surgeon and anesthesia fees are also key to the total cost. For robotic surgeries, these fees might be higher. This is because the surgery requires special training and expertise.

Surgeon fees: These vary based on the surgeon’s experience and the surgery’s complexity.

Anesthesia fees: These depend on the surgery’s length and the anesthesiologist’s fees.

Recovery and Follow-up Expense Differences

Recovery and follow-up costs can vary a lot between traditional and robotic surgeries. Robotic surgery often means shorter hospital stays and less recovery time. This can lead to lower overall costs.

|

Expense Category |

Traditional Approach |

Robotic Approach |

|---|---|---|

|

Hospital Stay |

5-7 days |

2-4 days |

|

Follow-up Care |

More intensive |

Less intensive |

Different Heart Valve Replacement Types and Insurance Considerations

Choosing between mechanical, biological, and other valve options affects both patient outcomes and insurance. Heart valve replacement surgery replaces a diseased valve with a mechanical or biological one, or uses TAVR. Each option impacts insurance differently.

Mechanical Valve Replacement Coverage

Mechanical valves are made of durable materials like titanium or pyrolytic carbon. They last long but need lifelong anticoagulation therapy to prevent blood clots. Insurance usually covers the valve, surgery, and follow-up care, including anticoagulation medication. It’s essential to check with your insurer about the specifics of your coverage.

Biological Valve Replacement Insurance Factors

Biological valves are made from animal tissue and may not need lifelong anticoagulation therapy. They might need to be replaced more often than mechanical valves. Insurance usually covers the valve cost, surgical fees, and hospital stay. Some insurance plans may have different coverage policies for biological valves, so it’s important to review your plan’s details.

TAVR Procedure Insurance Coverage

TAVR is a minimally invasive procedure for aortic valve replacement. It’s often covered by insurance for those at high risk for open-heart surgery. Coverage includes the device, procedure, and hospital costs. Insurance plans vary in TAVR coverage, and some may require pre-approval. Understanding your insurance plan’s policy on TAVR is vital.

Minimally Invasive Options and Coverage Variations

Minimally invasive heart valve surgery, including robotic-assisted surgery, is becoming more common. Insurance coverage for these procedures can vary a lot. Some insurers cover them fully, while others may consider them investigational or require additional approvals. It’s important to discuss your options with both your surgeon and insurance provider to understand what is covered under your plan.

Out-of-Pocket Maximums and Financial Planning

When you’re getting ready for heart valve replacement surgery, knowing your insurance plan’s out-of-pocket limits is key. It helps you get financially ready. Learning about out-of-pocket maximums and planning can help you handle your costs well.

Understanding Your Plan’s Out-of-Pocket Limits

Out-of-pocket maximums are the most you pay for healthcare in a year. Once you hit this limit, your insurance covers everything. It’s important to check your policy to see what counts towards this limit.

Calculating Your Total Financial Exposure

To figure out your total costs, think about the expenses for robotic heart surgery. This includes surgeon fees, hospital bills, and aftercare. Creating a detailed budget helps you plan for these costs.

Timing Surgery Around Benefit Year Considerations

Planning your surgery for the right time in your insurance year can save you money. Knowing when your benefits start over is key. Consult with your insurance provider to find the best time for your surgery.

Health Savings Accounts and Flexible Spending Options

Using Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) can save you money. They let you set aside money for medical costs before taxes. This can help with your surgery costs, like copays and deductibles.

|

Insurance Plan |

Out-of-Pocket Maximum |

Estimated Surgery Cost |

Patient Responsibility |

|---|---|---|---|

|

Plan A |

$5,000 |

$50,000 |

$5,000 |

|

Plan B |

$7,000 |

$50,000 |

$7,000 |

|

Plan C |

$3,000 |

$50,000 |

$3,000 |

Knowing your insurance plan’s out-of-pocket maximums and using tools like HSAs and FSAs can help manage your robotic heart surgery costs.

Financial Assistance Programs for Heart Surgery Patients

Financial help is key for heart surgery patients. It makes medical billing easier and lessens the cost of treatment.

Hospital Charity Care Programs

Hospitals have charity care for those who can’t pay their bills. These programs can cut or wipe out heart surgery costs.

To get help, patients must show they meet income rules and provide financial info. Financial counselors at hospitals can help with the application.

Key aspects of hospital charity care programs include:

- Income-based eligibility criteria

- Application process involving financial disclosure

- Potential for full or partial bill reduction

Manufacturer Patient Assistance Programs

Device makers have patient help programs for heart surgery costs.

“These programs can be a lifeline for patients who are struggling to afford the devices they need for their treatment,” said a healthcare provider.

To qualify, patients must show they need help and have the right insurance. Ask your doctor about these programs.

|

Program Type |

Eligibility Criteria |

Benefits |

|---|---|---|

|

Hospital Charity Care |

Income guidelines, financial need |

Reduced or eliminated medical bills |

|

Manufacturer Assistance |

Insurance status, financial need |

Discounts on medical devices |

Nonprofit Organizations Providing Support

Nonprofits offer financial aid to heart surgery patients. They give grants and other support to cover medical costs.

Some focus on heart conditions, while others help with general medical costs.

Government Assistance Options

Government programs like Medicaid or state help might be available. Check if you qualify.

Comparing Insurance Plans for Heart Surgery Coverage

Choosing the right insurance plan is key for heart surgery patients. It helps them get the care they need without breaking the bank. Understanding the differences in insurance plans is important for heart surgery coverage.

Key Policy Features to Evaluate

When looking at insurance plans, several key features are important. Deductibles, copays, and coinsurance affect how much you pay out of pocket. It’s also vital to check if your doctor is in the plan’s network.

The annual out-of-pocket maximum is another key factor. It limits how much you pay for healthcare in a year. Knowing these details helps you choose the right insurance.

Questions to Ask Insurance Representatives

To fully understand your coverage, ask your insurance rep some key questions. You should ask about:

- What are the coverage limitations for robotic heart surgery?

- Are there specific requirements for pre-authorization or pre-approval?

- How does the plan handle out-of-network care, if necessary?

- What are the procedures for appealing a denied claim?

These questions help you understand your coverage better. This way, you can make informed decisions about your care.

Special Enrollment Considerations

If your health insurance needs change due to heart surgery, Special Enrollment Periods (SEPs) might be available. SEPs let you enroll in or change plans outside the usual open enrollment. This is for big life changes or losing coverage.

Employer-Sponsored vs. Marketplace Plan Differences

Deciding between employer-sponsored plans and Marketplace plans is important. Employer plans are through work and might be cheaper and more complete. Marketplace plans are bought directly and can be cheaper based on income.

Each plan has its pros and cons. Employer plans might have tighter networks but are often cheaper. Marketplace plans offer more provider choices but can cost more without employer help.

Patient Case Studies: Insurance Coverage Experiences

Real-life patient stories offer insights into insurance coverage for robotic heart surgery. These stories show how patients deal with the complex healthcare system.

Medicare Patient Experience

A Medicare patient had robotic mitral valve repair. The process was easy, with Medicare covering most costs. “I was surprised by how smoothly everything went,” the patient said. “My healthcare team worked closely with Medicare to ensure all necessary preapprovals were in place.”

This shows how important teamwork between healthcare providers and insurance is. For Medicare patients, knowing about Part A and Part B is key to understanding costs.

Private Insurance Success Story

A patient with private insurance had a tough time but got coverage for robotic heart surgery. The success came from detailed preapproval and the team’s advocacy. “We worked closely with the insurance company to provide all necessary documentation,” said the surgeon. “In the end, the patient received the care they needed.”

This story shows how different private insurance can be. Patients need to be proactive in understanding their policies.

Overcoming Initial Coverage Denial

One patient faced denial for robotic heart surgery but won after appealing. The appeal included more medical info and a surgeon’s letter. “It’s key for patients to know their appeal rights,” said the financial counselor. “Being persistent can really help.”

This case shows the value of a well-planned appeal process. It can lead to coverage even after a first denial.

Managing Unexpected Costs

Even with insurance, some patients face unexpected costs. One patient found out that some services, like rehab, weren’t fully covered. “We were surprised by the out-of-pocket costs for follow-up care,” the patient said.

To avoid surprises, patients should ask for cost estimates and review their insurance policies. This can help them understand any exclusions or limits.

Working with Your Healthcare Team on Insurance Matters

Dealing with insurance for robotic heart surgery can be tough. But, with your healthcare team’s help, it gets easier. They’re not just about your medical care. They also help you understand and manage your insurance.

The Role of Hospital Financial Counselors

Hospital financial counselors are key in insurance matters. They know your insurance benefits inside out. They can estimate costs and help with preauthorization.

These counselors give you insights on how your insurance covers robotic heart surgery. They also tell you what you might have to pay out of pocket.

Surgeon’s Office Insurance Specialists

Surgeon’s offices also have insurance specialists. They work with your surgeon’s team to get insurance approval. They help you understand your insurance provider’s needs.

Questions to Ask Before Scheduling Surgery

Before your surgery, ask important questions. This ensures you’re ready for the insurance and financial parts of your care. Ask about costs, insurance coverage, and any extra fees.

- What are the estimated costs for the procedure?

- What percentage of the costs will my insurance cover?

- Are there any additional fees associated with the surgery or hospital stay?

Obtaining Cost Estimates in Writing

Getting cost estimates in writing is vital. This should include all costs for your surgery, like surgeon fees and hospital charges. It helps you understand your financial responsibilities.

By working with your healthcare team and knowing your insurance, you can feel more confident about your robotic heart surgery.

Future of Insurance Coverage for Robotic Cardiac Surgery

New trends and studies are changing how insurance covers robotic cardiac surgery. As more proof of robotic surgery’s benefits comes out, insurance plans will likely change too.

Emerging Coverage Trends

Several new trends are shaping insurance for robotic cardiac surgery. These include:

- More use of robotic tech in heart surgery

- More research showing robotic surgery works well

- New insurance policies that fit new surgical methods

Impact of Outcomes Research on Policies

Outcomes research is key in shaping insurance for robotic cardiac surgery. Studies showing better patient results, quicker recovery, and fewer problems are very important.

Insurers are starting to cover more because of these studies. This trend will likely keep growing as more research comes out.

Cost-Effectiveness Studies Influence

Cost studies also play a big role in insurance for robotic cardiac surgery. These studies help insurers see the financial benefits of robotic surgery.

By looking at shorter hospital stays, fewer problems, and lower readmission rates, insurers can make better choices. This data is key in figuring out if robotic surgery is cost-effective.

- Less money spent on hospital stays

- Less chance of complications

- Less need for readmission

Advocacy Efforts for Expanded Coverage

Efforts by patients, doctors, and industry groups are important in changing insurance for robotic cardiac surgery. Together, they can make sure insurance keeps up with new cardiac care.

We urge patients and doctors to talk to insurers. Share your experiences and the benefits of robotic surgery. This teamwork can lead to better, more complete coverage.

Looking ahead, insurance for robotic cardiac surgery will keep changing. By keeping up with new trends, research, and cost studies, we can better understand the future of cardiac care coverage.

Conclusion: Making Informed Decisions About Robotic Heart Surgery and Insurance

Understanding robotic heart surgery and insurance can be tough. We’ve looked at the latest in robotic heart surgery, what insurance covers, and the costs of replacing heart valves.

Knowing the benefits and what insurance covers helps patients make smart choices. Insurance is key, so it’s important to know about different plans, getting approval, and help programs.

We urge patients and their families to team up with their doctors and insurance companies. This way, they can get the care they need and make the best choices about robotic heart surgery and insurance. This approach helps them achieve the best results.

FAQ

Does insurance typically cover robotic heart surgery?

Yes, most health insurance plans cover cardiac surgery, including robotic methods. But, coverage can vary by plan and procedure.

What is the average cost of heart valve replacement surgery with insurance?

The cost of heart valve replacement surgery varies. It depends on the valve type and surgical method. Insurance coverage also varies by plan.

How does Medicare cover robotic cardiac surgery?

Medicare covers robotic cardiac surgery. It covers hospital costs under Part A and surgeon fees under Part B. Medicare Advantage plans may offer more coverage.

What are the differences in insurance coverage between traditional and robotic heart surgery approaches?

Robotic surgery might have different insurance coverage than traditional surgery. It’s best to check your insurance plan for details.

How can I minimize my out-of-pocket expenses for heart valve replacement surgery?

To lower costs, know your insurance plan’s limits. Calculate your total costs. Use health savings accounts or flexible spending options.

Are there financial assistance programs available for heart surgery patients?

Yes, there are programs to help with costs. These include hospital charity care, manufacturer assistance, and government aid.

How do I compare insurance plans for heart surgery coverage?

Look at policy features like deductibles and copays. Ask about coverage specifics and any requirements or limits.

What is the role of medical necessity in determining insurance coverage for robotic heart surgery?

Medical necessity is key for coverage. Insurers use clinical guidelines to decide. Patients need to provide necessary documents to support their surgery need.

How can I navigate the preauthorization process for robotic heart surgery?

Before approval, submit required documents from your surgeon. Understand the approval timeline and how to handle denials to plan your care.

What are the costs associated with robotic mitral valve repair?

Costs for robotic mitral valve repair vary. They depend on the surgical approach, hospital charges, and surgeon fees. Recovery and follow-up costs also differ.

How do different heart valve replacement types affect insurance coverage?

Coverage varies for mechanical, biological, and TAVR valve replacements. Minimally invasive procedures have different coverage too, depending on the insurer.

What is the future of insurance coverage for robotic cardiac surgery?

Coverage for robotic cardiac surgery may grow. This is due to research and cost studies. Advocacy by patients and professionals will also influence coverage decisions.