Nearly 252 million adults in the United States are either overweight or obese, making weight loss surgery a viable option for many. But, a crucial question remains: is gastric sleeve surgery covered by insurance? The answer is complex, as coverage varies depending on the insurance provider and policy.An amazing guide to gastric sleeve insurance. Learn the critical steps and proven secrets to getting your procedure approved.

We understand that navigating insurance coverage can be overwhelming. At our institution, we have helped numerous patients secure coverage for bariatric surgery. Our team is dedicated to providing personalized support and comprehensive medical care to ensure a smooth process.

Understanding the specifics of your insurance policy is essential to determining the extent of coverage for gastric sleeve surgery. Factors such as the type of insurance, policy terms, and medical necessity play a significant role in determining coverage.

Key Takeaways

- Gastric sleeve surgery coverage varies by insurance provider and policy.

- Understanding your insurance policy terms is crucial to determining coverage.

- Medical necessity is a key factor in determining insurance coverage.

- Our team provides personalized support and comprehensive medical care.

- We help patients navigate the insurance coverage process for bariatric surgery.

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage.

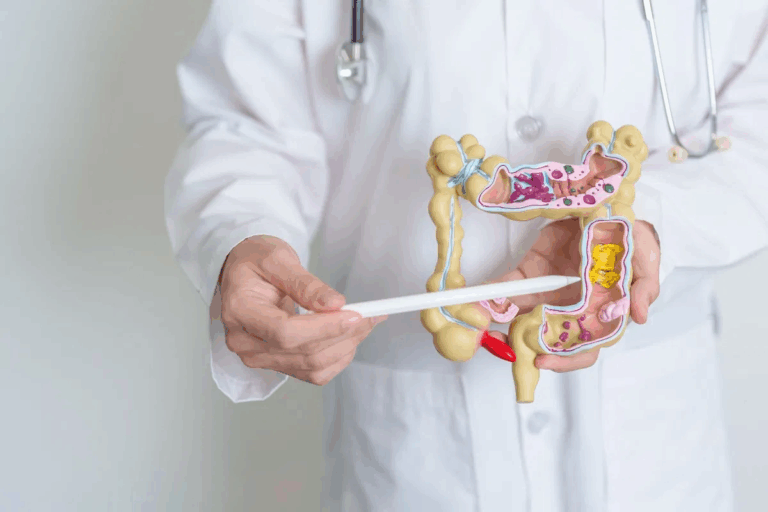

As a leading bariatric surgery option, gastric sleeve surgery offers a promising solution for individuals struggling with obesity. We recognize the importance of understanding this procedure to make informed decisions about your health.

What is Gastric Sleeve Surgery?

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage.

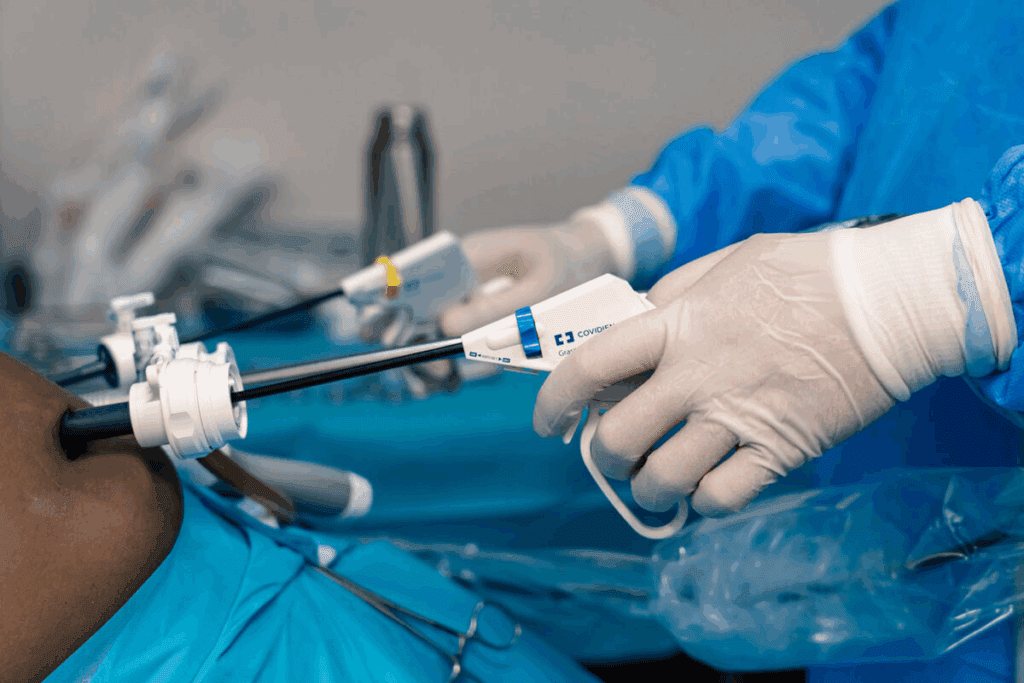

The procedure is typically performed laparoscopically, using small incisions and a camera to guide the surgery. This approach not only reduces recovery time but also minimizes scarring.

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage.

The benefits of gastric sleeve surgery are multifaceted, making it an attractive option for many:

- Significant Weight Loss: Patients can expect to lose a substantial amount of weight, improving overall health and reducing obesity-related conditions.

- Improved Health Conditions: Weight loss resulting from gastric sleeve surgery can lead to improvements in conditions such as type 2 diabetes, hypertension, and sleep apnea.

- Reduced Hunger: The surgery involves removing a portion of the stomach that produces the hunger hormone ghrelin, leading to reduced hunger and easier adherence to a healthy diet.

- Minimally Invasive: The laparoscopic approach minimizes recovery time and reduces the risk of complications.

Who is a Good Candidate?

Determining candidacy for gastric sleeve surgery involves evaluating several factors, including:

- BMI: Typically, individuals with a BMI of 40 or higher, or those with a BMI of 35 or higher with obesity-related health conditions, are considered good candidates.

- Previous Weight Loss Attempts: Candidates usually have a history of unsuccessful weight loss attempts through diet and exercise.

- Overall Health: Patients should be in good overall health, without conditions that would significantly increase surgical risks.

- Commitment to Lifestyle Changes: Success with gastric sleeve surgery requires a commitment to adopting healthier lifestyle habits post-surgery.

We work closely with patients to evaluate their suitability for gastric sleeve surgery, ensuring they are well-informed and prepared for the journey ahead.

The Role of Insurance in Gastric Sleeve Coverage

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage. As we explore the intricacies of insurance coverage for gastric sleeve surgery, it’s essential to understand the factors that influence this coverage.

How Insurance Companies View Gastric Sleeve Surgery

Insurance companies have varying policies regarding gastric sleeve surgery, with some covering it under certain conditions. Bariatric insurance coverage is a critical aspect, as it determines the extent to which the surgery is covered. We will examine how different insurance providers view this surgery and what it means for patients.

Generally, insurance companies consider gastric sleeve surgery a medically necessary procedure for individuals with severe obesity, especially when other weight loss attempts have failed. However, the criteria for approval can differ significantly among insurers.

Importance of Health Insurance for Surgery

Health insurance plays a crucial role in covering the costs associated with gastric sleeve surgery. For many patients, the cost of the surgery is prohibitively expensive without insurance. Health insurance for surgery can significantly reduce out-of-pocket expenses, making the procedure more accessible.

Having appropriate insurance coverage not only alleviates financial burdens but also provides patients with access to a network of experienced healthcare professionals and facilities. This is particularly important for a complex procedure like gastric sleeve surgery, where the quality of care can significantly impact outcomes.

To ensure that you have the necessary coverage, it’s vital to review your insurance policy and understand its terms regarding insurance weight loss surgery. This includes knowing what is covered, what is not, and any conditions that must be met to qualify for coverage.

Eligibility Criteria for Coverage

Understanding the eligibility criteria for gastric sleeve surgery coverage is crucial for patients considering this weight loss procedure. Insurance providers have specific requirements that must be met to qualify for coverage.

BMI Requirements for Insurance Approval

One of the primary factors in determining eligibility for gastric sleeve surgery coverage is the patient’s Body Mass Index (BMI). Generally, insurance companies require a BMI of 40 or higher, or a BMI of 35 or higher with one or more obesity-related health conditions, such as diabetes or hypertension.

BMI Category | Typical Insurance Requirement |

BMI 40 or higher | Generally covered without additional health conditions |

BMI 35-39.9 with health conditions | Covered if accompanied by conditions like diabetes or hypertension |

Medical Necessity Criteria

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage.

- Previous attempts at weight loss through diet and exercise

- Presence of obesity-related health conditions

- Psychological evaluation to assess readiness for surgery

Documentation Needed for Insurance Submission

To support the insurance claim, patients must gather and submit comprehensive documentation. This includes medical records, test results, and letters from healthcare providers.

Required Documentation:

- Medical records detailing previous weight loss attempts

- Laboratory test results

- Letters from healthcare providers explaining the medical necessity of the surgery

Insurance Plans and Their Variations

Understanding the nuances of insurance plans is crucial for patients considering gastric sleeve surgery. Insurance coverage can significantly impact the overall cost of the procedure, and knowing the differences between various insurance plans can help patients make informed decisions.

Key Differences in Coverage Among Insurers

Insurance companies have different policies regarding gastric sleeve surgery. Some may require pre-authorization, while others may have specific criteria that must be met before coverage is approved. It’s essential for patients to review their insurance policy documents or contact their insurer directly to understand what is covered and what is not.

“Insurance coverage for weight loss surgery is not a one-size-fits-all proposition. Patients must navigate the specifics of their plan to understand their coverage.” –

A leading bariatric surgeon

In-Network vs. Out-of-Network Providers

Another critical aspect to consider is whether the healthcare provider is in-network or out-of-network. In-network providers have a contract with the insurance company to provide care at a negotiated rate, which typically results in lower out-of-pocket costs for the patient. Out-of-network providers, however, do not have such a contract, and patients may face significantly higher costs or even full charges for the procedure.

- In-network providers offer discounted rates, reducing out-of-pocket expenses.

- Out-of-network providers may result in higher costs or denied claims.

- Patients should verify the network status of their healthcare providers before proceeding.

By understanding these variations in insurance plans and provider networks, patients can better navigate the complex process of getting gastric sleeve surgery covered by their insurance.

Out-of-Pocket Costs for Gastric Sleeve Surgery

Understanding the out-of-pocket costs for gastric sleeve surgery is crucial for patients considering this life-changing procedure. The financial burden can be significant, and being prepared is essential.

Typical Costs Without Insurance

The cost of gastric sleeve surgery without insurance can vary widely based on several factors, including the surgeon’s fees, hospital charges, and geographical location. On average, the total cost can range from $15,000 to $25,000. This includes pre-operative tests, the surgical procedure, hospital stay, and post-operative care.

It’s essential to break down these costs to understand where the majority of the expense lies. For instance, the surgeon’s fee can range from $5,000 to $10,000, while hospital charges can add another $8,000 to $15,000, depending on the length of stay and services provided.

Managing Out-of-Pocket Expenses

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage.

Patients can also explore various strategies to reduce costs, such as choosing an in-network provider, negotiating with the hospital or surgeon for a better rate, or considering surgical packages that include all necessary services.

Payment Plans and Financing Options

For many patients, the out-of-pocket cost for gastric sleeve surgery can be managed through payment plans or financing options. Many surgical centers and hospitals offer financing plans that allow patients to pay for the procedure over time, rather than all at once.

- Financing Options: Some providers partner with financing companies that specialize in medical loans. These loans can offer competitive interest rates and flexible repayment terms.

- Payment Plans: Direct payment plans with the healthcare provider can also be arranged. These plans allow patients to make monthly payments until the total cost is covered.

- Medical Credit Cards: Specialized credit cards for medical expenses can be another option, offering promotional periods with no interest if paid within a certain timeframe.

It’s crucial for patients to carefully review the terms of any financing option or payment plan to ensure it fits within their budget.

Pre-Authorization Process

Pre-authorization is a critical phase in the insurance approval process for bariatric surgery, requiring careful preparation and documentation. We guide you through this complex process to ensure a successful outcome.

Steps to Obtain Pre-Authorization

To obtain pre-authorization, several steps must be followed meticulously:

- Initial Consultation: Your healthcare provider will assess your eligibility for gastric sleeve surgery and discuss the insurance coverage.

- Documentation Gathering: We help you collect necessary documents, including medical records, BMI history, and letters of medical necessity.

- Pre-Authorization Request: Your healthcare provider submits a pre-authorization request to the insurance company, including detailed information about your condition and the proposed treatment.

- Insurance Review: The insurance company reviews your request, which may involve additional information or clarification.

- Decision Notification: You receive a decision regarding your pre-authorization request, which could be an approval, denial, or request for further information.

Common Challenges in the Approval Process

Several challenges can arise during the pre-authorization process, including:

- Incomplete Documentation: Ensuring that all required documents are submitted accurately and completely is crucial.

- Insurance Policy Limitations: Understanding the specifics of your insurance policy, including any exclusions or limitations, is vital.

- Medical Necessity Criteria: Meeting the insurance company’s criteria for medical necessity can be challenging and requires thorough documentation.

Tips for a Successful Pre-Authorization

To enhance the likelihood of a successful pre-authorization, consider the following tips:

- Work Closely with Your Healthcare Provider: Collaboration with your healthcare team is essential for gathering the necessary documentation and ensuring that your pre-authorization request is comprehensive.

- Understand Your Insurance Policy: Familiarize yourself with your insurance coverage, including any requirements or limitations related to bariatric surgery.

- Be Proactive: Stay engaged throughout the pre-authorization process, and be prepared to provide additional information as needed.

By understanding the pre-authorization process and working closely with your healthcare provider, you can navigate this critical step with confidence.

Coverage Limitations and Exclusions

Insurance policies often have specific limitations and exclusions that can impact coverage for gastric sleeve surgery. Understanding these limitations is crucial for patients to navigate their insurance plans effectively.

Common Exclusions in Insurance Policies

Insurance policies may exclude certain conditions or procedures related to gastric sleeve surgery. Common exclusions include:

- Pre-existing conditions that are not covered under the policy.

- Procedures deemed not medically necessary.

- Complications arising from previous surgeries not related to the current procedure.

It’s essential for patients to review their insurance policies carefully to understand what is excluded.

Lifetime Limits on Coverage for Weight Loss Surgery

Some insurance policies impose lifetime limits on coverage for weight loss surgeries, including gastric sleeve surgery. This means that even if a patient has a comprehensive insurance plan, there might be a cap on the amount the insurer will pay for such procedures over the patient’s lifetime.

Insurance Provider | Lifetime Limit | Coverage Details |

Provider A | $100,000 | Covers gastric sleeve surgery with pre-authorization. |

Provider B | $50,000 | Limited coverage; requires additional premium for full coverage. |

Provider C | No Limit | Comprehensive coverage with certain conditions. |

What to Do if Your Claim is Denied

If an insurance claim for gastric sleeve surgery is denied, patients should:

- Review the denial letter to understand the reason for denial.

- Gather additional documentation or evidence to support the claim.

- File an appeal with the insurance company, following their appeals process.

It’s crucial to act promptly and seek assistance if needed. Patients can also seek help from their healthcare provider or a patient advocate to navigate the appeals process.

The Appeal Process for Denied Claims

A denied insurance claim doesn’t have to be the end of your journey; we guide you through the appeal process, ensuring you understand your options and the steps to achieve a successful outcome.

Understanding the Denial Letter

The first step in the appeal process is to carefully review the denial letter sent by your insurance provider. This letter will outline the reasons for the denial and provide instructions on how to appeal the decision.

Key elements to look for in the denial letter include:

- The specific reason for the denial

- The procedure for filing an appeal

- The deadline for submitting an appeal

Steps to Appeal a Denial

Once you understand the denial letter, you can begin the appeal process. Here are the general steps involved:

- Gather necessary documentation: Collect all relevant medical records, letters from your doctor, and any other supporting documents that justify the medical necessity of your gastric sleeve surgery.

- Write an appeal letter: Craft a clear and concise appeal letter that addresses the reasons for the denial and includes supporting evidence.

- Submit the appeal: Send the appeal letter and supporting documents to your insurance provider within the specified timeframe.

- Follow up: After submitting your appeal, follow up with your insurance provider to ensure they have received your documents and to inquire about the status of your appeal.

Helpful Resources for the Appeal Process

Navigating the appeal process can be challenging, but there are resources available to help. Consider the following:

- Patient advocacy groups: Organizations that specialize in helping patients navigate insurance issues can provide valuable guidance and support.

- Your healthcare provider: Your surgeon and their staff can often provide additional documentation and support for your appeal.

- Insurance company resources: Some insurance companies have dedicated resources and personnel to help patients with the appeal process.

By understanding the appeal process and utilizing available resources, you can effectively navigate a denied claim and work towards a successful outcome.

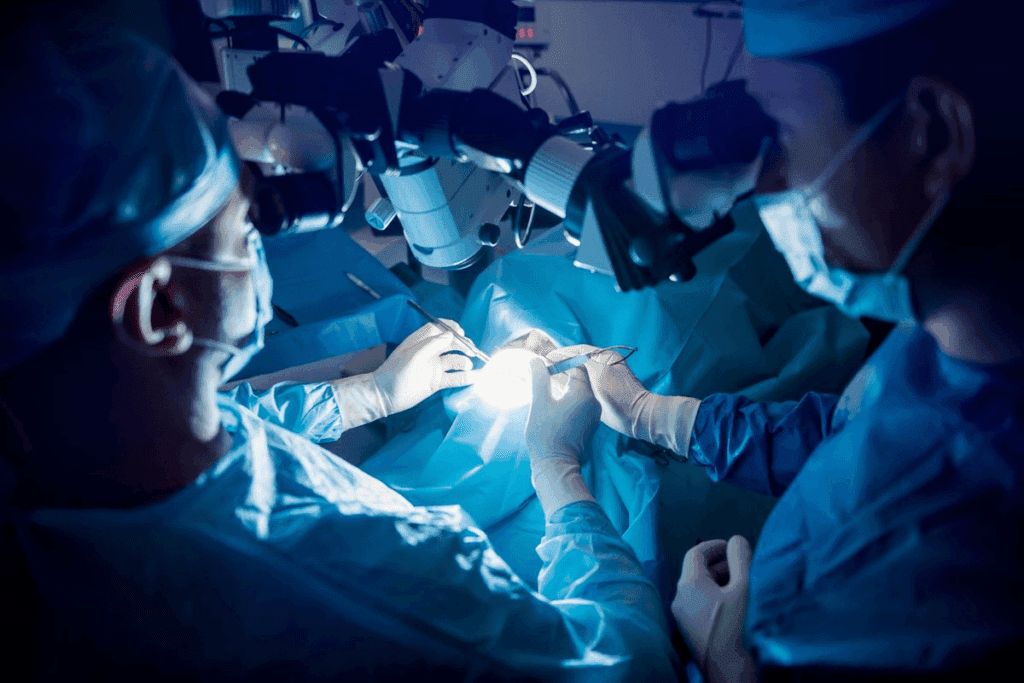

Finding a Gastric Sleeve Surgeon

When it comes to gastric sleeve surgery, finding a qualified and experienced surgeon is paramount. The success of your surgery largely depends on the skill and expertise of your surgeon.

Qualities to Look for in a Surgeon

Choosing a qualified gastric sleeve surgeon involves considering several key factors. You should look for a surgeon who is board-certified and has extensive experience in performing gastric sleeve surgeries. It’s also crucial to check their credentials and read reviews from previous patients to gauge their reputation and patient satisfaction rates.

Here are some qualities to look for in a gastric sleeve surgeon:

- Board certification in general surgery or a related field

- Extensive experience with gastric sleeve surgeries

- Positive patient reviews and testimonials

- A comprehensive approach to patient care, including pre- and post-surgery support

The Importance of a Surgeon’s Experience

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage.

Surgeon Qualities | Importance | How to Verify |

Board Certification | Ensures the surgeon has the necessary training and expertise | Check with the relevant medical board or certification website |

Experience with Gastric Sleeve Surgeries | Increases the likelihood of a successful outcome | Ask about their experience and success rates during your consultation |

Patient Reviews | Provides insight into patient satisfaction and the surgeon’s reputation | Read online reviews and ask for references |

Questions to Ask During Your Consultation

During your initial consultation, it’s essential to ask the right questions to ensure you’re making an informed decision. Some key questions to ask include:

- What experience do you have with gastric sleeve surgeries?

- What are your success rates, and how do you handle complications?

- Can you share testimonials or references from previous patients?

- What kind of support do you offer before and after surgery?

By carefully evaluating these factors and asking the right questions, you can find a qualified gastric sleeve surgeon who meets your needs and helps you achieve your weight loss goals.

Lifestyle Changes After Gastric Sleeve

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage.

Dietary Adjustments Post-Surgery

Dietary changes are a cornerstone of the post-gastric sleeve lifestyle. Initially, patients will follow a liquid diet, gradually transitioning to pureed foods and eventually to solid foods. It’s essential to:

- Eat smaller, more frequent meals to avoid discomfort and nutritional deficiencies.

- Choose nutrient-dense foods, including lean proteins, vegetables, and whole grains.

- Avoid high-calorie, high-sugar, and high-fat foods that can hinder weight loss and cause discomfort.

- Stay hydrated by drinking plenty of water throughout the day.

We recommend working with a nutritionist or dietitian to develop a personalized meal plan that meets your nutritional needs and supports your weight loss goals.

Exercise Recommendations

Regular physical activity is vital for enhancing weight loss, improving overall health, and reducing the risk of complications. We suggest:

- Starting with low-intensity exercises such as walking, yoga, or swimming, and gradually increasing the intensity and duration as your body allows.

- Aiming for at least 150 minutes of moderate-intensity exercise or 75 minutes of vigorous-intensity exercise per week.

- Incorporating strength training exercises to build muscle mass and boost metabolism.

It’s crucial to listen to your body and not push yourself too hard, especially in the early stages of recovery. Consulting with a healthcare professional or a fitness expert can help you develop an exercise plan that’s tailored to your needs and abilities.

Long-term Health Monitoring

Long-term health monitoring is a critical aspect of post-gastric sleeve care. Regular follow-up appointments with your healthcare provider will help monitor your progress, address any complications, and make necessary adjustments to your lifestyle plan.

Key aspects of long-term health monitoring include:

- Regular check-ups to monitor weight loss, nutritional status, and overall health.

- Blood tests to check for nutritional deficiencies and other potential complications.

- Ongoing support and guidance to help you navigate any challenges and maintain your weight loss.

By committing to these lifestyle changes and working closely with your healthcare team, you can achieve the best possible outcomes from your gastric sleeve surgery and enjoy a healthier, more fulfilling life.

Success Rates and Outcomes

With its high success rates and positive outcomes, gastric sleeve surgery is becoming an increasingly popular choice for weight loss. We have seen significant advancements in obesity treatment, offering new hope to those affected.

The journey to gastric sleeve surgery includes both medical evaluations and navigating insurance coverage.

Gastric sleeve surgery has been shown to be highly effective in achieving substantial weight loss and improving obesity-related health conditions. Studies have indicated that patients typically lose between 50% to 75% of their excess body weight within the first year after surgery.

The surgery’s effectiveness can be attributed to several factors, including the reduction in stomach size, which limits food intake, and hormonal changes that help reduce hunger and improve metabolic function.

Key Benefits:

- Significant weight loss

- Improvement in obesity-related health conditions

- Enhanced quality of life

Patient Satisfaction and Success Stories

Patient satisfaction rates following gastric sleeve surgery are generally high, with many reporting improved overall health and well-being. The surgery not only aids in weight loss but also has a positive impact on mental health and self-esteem.

“The gastric sleeve surgery was a game-changer for me. I’ve lost over 100 pounds and feel like a new person. My health has improved dramatically, and I’m grateful for the decision I made.” –

A patient testimonial

Success stories like these highlight the potential of gastric sleeve surgery to transform lives. Factors contributing to successful outcomes include comprehensive pre-surgical evaluation, skilled surgical care, and post-operative support.

Outcome | Percentage | Average Weight Loss |

Significant Weight Loss | 80% | 60% of excess body weight |

Improvement in Comorbidities | 75% | N/A |

Patient Satisfaction | 90% | N/A |

Resources for Patients

Patients considering gastric sleeve surgery can benefit from various resources that support their journey. We provide access to comprehensive patient resources, including insurance guidance, support groups, and educational materials.

Accessing Insurance Resources

Understanding insurance coverage is crucial for managing the costs associated with gastric sleeve surgery. We offer insurance resources and contact information to help patients navigate their coverage options and ensure they receive the necessary support.

Support and Education

Support groups and educational materials play a vital role in a patient’s preparation and recovery. We connect patients with support groups and provide educational materials on gastric sleeve surgery to empower them with knowledge about their procedure and post-operative care.

By leveraging these patient resources, individuals can make informed decisions and feel supported throughout their gastric sleeve surgery journey.

FAQ

Is gastric sleeve surgery typically covered by insurance?

Many insurance plans cover gastric sleeve surgery, but coverage depends on the specific policy and the patient’s condition. We recommend checking with your insurance provider to determine the extent of your coverage and understanding the requirements for bariatric insurance approval.

What are the eligibility criteria for gastric sleeve insurance coverage?

Eligibility criteria often include a BMI of 40 or higher, or a BMI of 35 with obesity-related health conditions, and documentation of previous weight loss attempts. Insurance companies may also require a letter of medical necessity and other supporting documents for bariatric coverage.

How do I find out if my insurance plan covers gastric sleeve surgery?

To determine if your insurance plan covers gastric sleeve surgery, review your policy documents or contact your insurance provider directly. Ask about their bariatric surgery insurance coverage, including any out-of-pocket costs, pre-authorization requirements, and necessary documentation.

What is the pre-authorization process for gastric sleeve surgery?

The pre-authorization process involves submitting a request to your insurance company, along with required documentation, such as medical records and a letter of medical necessity. We can help guide you through this process to ensure a smooth and successful pre-authorization for your weight loss surgery coverage.

What are the typical out-of-pocket costs for gastric sleeve surgery?

Out-of-pocket costs for gastric sleeve surgery vary depending on your insurance plan, deductible, copays, and coinsurance. Even with insurance coverage, patients may need to pay some expenses out-of-pocket. We can help you understand the estimated costs and explore financing options or payment plans.

Can I appeal a denied claim for gastric sleeve surgery?

Yes, if your claim is denied, you can appeal the decision. We recommend understanding the reason for the denial, gathering additional supporting documentation, and submitting a formal appeal to your insurance company. We can assist you in navigating the appeal process for your bariatric surgery insurance claim.

How do I choose a qualified gastric sleeve surgeon?

To choose a qualified gastric sleeve surgeon, consider their experience, credentials, and patient reviews. Look for a surgeon who is board-certified and has extensive experience in performing gastric sleeve surgery. We can help you find a qualified surgeon who meets your needs.

What lifestyle changes are required after gastric sleeve surgery?

After gastric sleeve surgery, patients need to make significant lifestyle changes, including dietary adjustments, regular exercise, and long-term health monitoring. We provide guidance on maintaining a healthy lifestyle post-surgery to ensure optimal results and overall well-being.

Are there any resources available to support patients undergoing gastric sleeve surgery?

Yes, there are various resources available to support patients, including insurance resources, support groups, and educational materials. We can provide you with information and guidance on accessing these resources to help you throughout your journey.

How effective is gastric sleeve surgery in achieving weight loss?

Gastric sleeve surgery is a highly effective weight loss surgery, with many patients achieving significant weight loss and improvement in obesity-related health conditions. We can share success stories and provide information on the effectiveness of gastric sleeve surgery.

Reference

National Center for Biotechnology Information. Evidence-Based Medical Insight. Retrieved from https://pubmed.ncbi.nlm.nih.gov/?term=gastric+sleeve+surgery**